Featured

Table of Contents

- – How do I apply for Term Life Insurance With Fi...

- – What is the most popular Level Premium Term Li...

- – What is the most popular Level Term Life Insu...

- – What is the most popular Level Term Life Insu...

- – How can I secure Level Term Life Insurance R...

- – How can Level Term Life Insurance Premiums p...

Premiums are generally reduced than whole life plans. With a degree term policy, you can pick your protection quantity and the policy size. You're not secured into an agreement for the rest of your life. Throughout your plan, you never have to stress over the premium or death advantage amounts transforming.

And you can not squander your plan during its term, so you will not receive any kind of economic gain from your previous protection. Similar to other types of life insurance, the price of a level term policy depends upon your age, coverage demands, employment, way of life and health and wellness. Generally, you'll discover a lot more inexpensive coverage if you're younger, healthier and much less risky to guarantee.

Since level term premiums remain the exact same throughout of coverage, you'll understand exactly just how much you'll pay each time. That can be a large aid when budgeting your costs. Degree term coverage also has some versatility, permitting you to tailor your policy with extra functions. These typically can be found in the kind of riders.

You may have to meet details conditions and credentials for your insurer to pass this biker. There additionally might be an age or time limit on the insurance coverage.

How do I apply for Term Life Insurance With Fixed Premiums?

The fatality benefit is typically smaller sized, and protection typically lasts until your child turns 18 or 25. This rider may be a more cost-efficient method to assist ensure your youngsters are covered as riders can commonly cover several dependents at when. When your child ages out of this insurance coverage, it might be feasible to transform the rider into a new plan.

The most common type of permanent life insurance coverage is entire life insurance coverage, yet it has some crucial differences compared to degree term protection. Right here's a fundamental overview of what to take into consideration when contrasting term vs.

Whole life entire lasts insurance coverage life, while term coverage lasts protection a specific periodParticular The costs for term life insurance policy are usually lower than whole life insurance coverage.

What is the most popular Level Premium Term Life Insurance plan in 2024?

One of the major attributes of degree term protection is that your premiums and your death benefit do not transform. You may have protection that starts with a death benefit of $10,000, which could cover a home mortgage, and after that each year, the fatality benefit will decrease by a set quantity or percentage.

As a result of this, it's often a more inexpensive sort of level term coverage. You might have life insurance policy with your employer, however it may not suffice life insurance policy for your demands. The primary step when acquiring a policy is determining just how much life insurance policy you need. Think about variables such as: Age Household size and ages Work standing Revenue Debt Lifestyle Expected last expenditures A life insurance policy calculator can help establish just how much you require to start.

After making a decision on a plan, complete the application. If you're approved, authorize the paperwork and pay your very first premium.

Lastly, take into consideration organizing time yearly to review your policy. You may intend to upgrade your beneficiary info if you have actually had any type of substantial life modifications, such as a marital relationship, birth or separation. Life insurance policy can occasionally really feel complicated. You do not have to go it alone. As you discover your alternatives, think about discussing your needs, desires and interests in a financial specialist.

What is the most popular Level Term Life Insurance Vs Whole Life plan in 2024?

No, level term life insurance policy doesn't have cash worth. Some life insurance policy plans have an investment feature that permits you to develop money worth over time. Level term life insurance coverage. A portion of your costs repayments is reserved and can make passion in time, which expands tax-deferred during the life of your protection

These policies are typically considerably more costly than term protection. You can: If you're 65 and your protection has run out, for example, you might desire to purchase a brand-new 10-year degree term life insurance policy.

What is the most popular Level Term Life Insurance Vs Whole Life plan in 2024?

You might be able to transform your term coverage into a whole life plan that will certainly last for the rest of your life. Many kinds of level term plans are exchangeable. That means, at the end of your protection, you can convert some or all of your plan to entire life insurance coverage.

Degree term life insurance policy is a policy that lasts a collection term typically between 10 and three decades and features a level fatality advantage and degree costs that stay the very same for the whole time the policy holds. This suggests you'll understand exactly how much your settlements are and when you'll need to make them, allowing you to budget plan as necessary.

Degree term can be a terrific alternative if you're aiming to get life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Research Study, 30% of all adults in the U.S (Level term life insurance benefits). need life insurance policy and do not have any type of policy. Level term life is predictable and budget friendly, which makes it among the most preferred kinds of life insurance policy

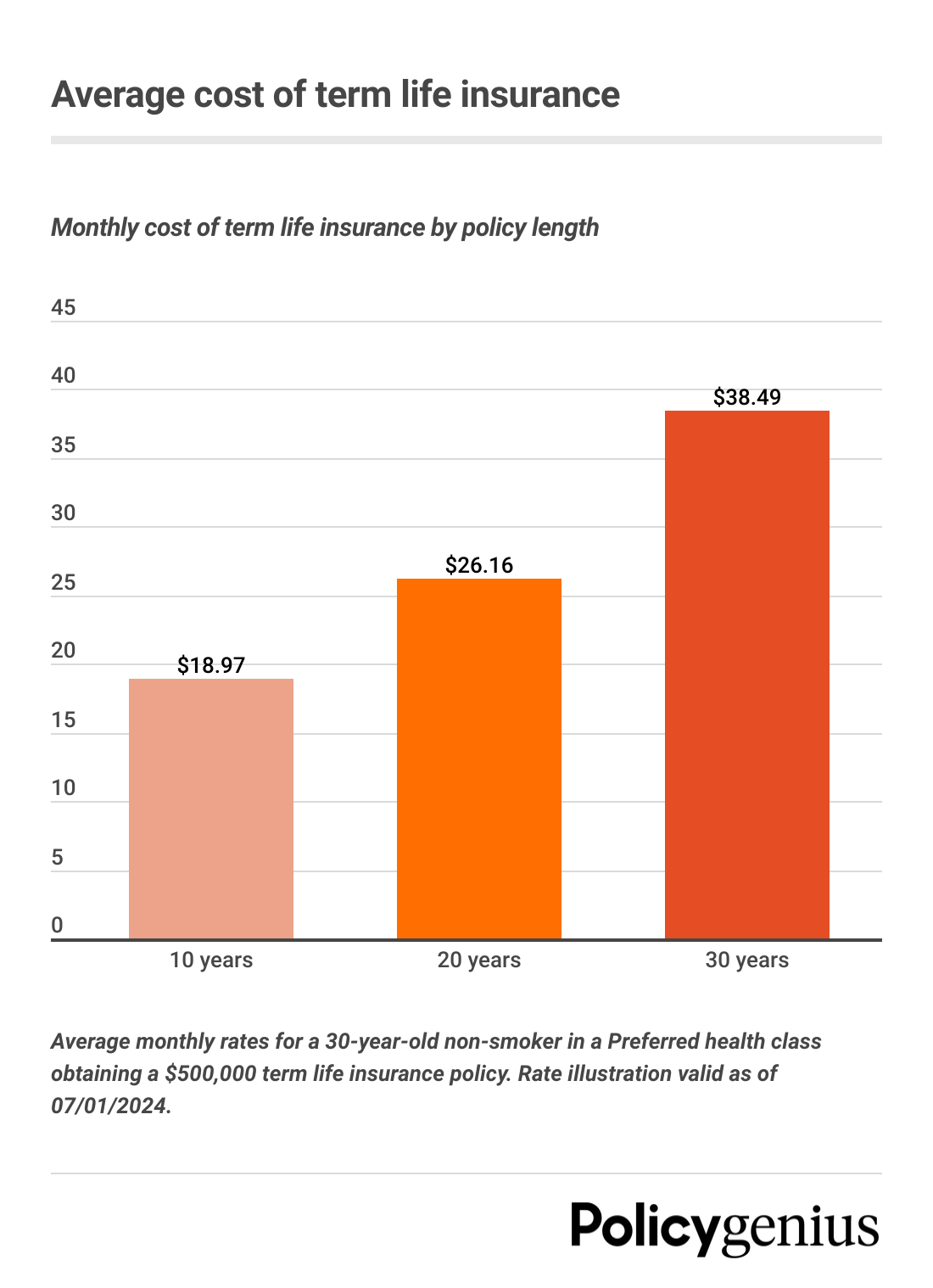

A 30-year-old man with a comparable account can anticipate to pay $29 monthly for the same protection. AgeGender$250,000 insurance coverage amount$500,000 insurance coverage quantity$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Ordinary month-to-month prices are determined for male and female non-smokers in a Preferred health category acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance coverage policy.

How can I secure Level Term Life Insurance Rates quickly?

Rates may differ by insurance company, term, insurance coverage quantity, health and wellness class, and state. Not all plans are readily available in all states. Rate image valid since 09/01/2024. It's the cheapest type of life insurance coverage for lots of people. Level term life is much extra affordable than an equivalent entire life insurance policy plan. It's simple to take care of.

It permits you to spending plan and plan for the future. You can easily factor your life insurance policy into your spending plan because the premiums never change. You can prepare for the future just as easily due to the fact that you know precisely just how much cash your loved ones will certainly obtain in case of your lack.

How can Level Term Life Insurance Premiums protect my family?

In these instances, you'll usually have to go with a brand-new application procedure to get a much better rate. If you still require insurance coverage by the time your level term life policy nears the expiry day, you have a few choices.

Table of Contents

- – How do I apply for Term Life Insurance With Fi...

- – What is the most popular Level Premium Term Li...

- – What is the most popular Level Term Life Insu...

- – What is the most popular Level Term Life Insu...

- – How can I secure Level Term Life Insurance R...

- – How can Level Term Life Insurance Premiums p...

Latest Posts

Final Expense Direct Reviews

Cremation Policy

Final Expenses Insurance For Seniors

More

Latest Posts

Final Expense Direct Reviews

Cremation Policy

Final Expenses Insurance For Seniors